Effective January 1, 2019, CMS required that a hospital publish their chargemaster online for consumers. At the time it was made clear by CMS that this would be the first of potentially many initiatives geared toward increasing transparency around hospital and other provider fees. The goal of all of these changes is to improve the ease and accuracy with which consumers can understand the expected out-of-pocket expenditures for patient care.

On November 15, 2019, CMS issued its Final 2020 Price Transparency rules, which expands the current requirements that will be effective January 1, 2021.

While the industry is challenging the rule as unconstitutional and exceeding the administration’s authority, there are strong arguments on both sides and the clock is ticking. Providers should not put preparations on hold due to a false sense of security that the rule will be overturned or pushed out to later years.

There are two new requirements:

- Annually, hospitals must provide a machine-readable file containing negotiated charges (rates) for ALL items and services.

- For 300 shoppable items and services only, including 70 defined by CMS if they are provided by the hospital, hospitals must provide a consumer-friendly display of gross charge and negotiated charges (rates).

Machine-Readable File Rule Highlights

Under the new rule, hospitals will be required to provide on their website without barriers, and for each provider within a health system, a machine-readable file containing the following data elements for ALL items and services:

- Description of each item or service (including both individual items and services and service packages).

- The corresponding gross charge for each item or service with indication of the inpatient or outpatient department setting.

- The corresponding payer-specific negotiated charge (rate) for items, services, and service packages with indication of the inpatient or outpatient department setting AND clear indication of the payer name and plan.

- De-identified minimum negotiated charge (rate) for items, services, and service packages with indication of the inpatient or outpatient department setting.

- De-identified maximum negotiated charge (rate) for items, services, and service packages with indication of the inpatient or outpatient department setting.

- The corresponding discounted cash price, if any, that applies to these same services above; where no discounted cash price is offered include the gross charge.

Users must be able to digitally search the data and CMS-specified naming convention for the file must be used: <ein>_<hospital-name>_standardcharges. (.json or xml or csv ). Additionally, the file must be updated no less than annually with the date of the last update clearly identified.

Consumer-Friendly Display Highlights

When displaying gross charges, negotiated charges (rates) and discounted cash prices for the 300 shoppable items in a consumer-friendly manner the following data element must be included:

- Plain language description of each shoppable service.

- An indication of when one or more of the 70 CMS shoppable services are not offered by the hospital. The hospital must replace such service with other shoppable service to achieve 300 if feasible to do so.

- The negotiated charge (rate) for each item or service package with third-party payer name and plan clearly identified.

- The discounted cash price that applies to each shoppable service (and corresponding ancillary services if applicable). If a discounted cash price is not offered for an item, the undiscounted gross charge should be displayed

- The de-identified minimum negotiated charge that applies to each shoppable service (and corresponding ancillary services if applicable).

- The de-identified maximum negotiated charge that applies to each shoppable service (and corresponding ancillary services if applicable).

- Indication of inpatient or outpatient setting of shoppable service.

- Any primary code used by the hospital for purposes of accounting or billing for the shoppable service, including, as applicable, the CPT code, the HCPCS code, the DRG, or other common service billing codes. For the 5 CMS shoppable MS-DRG codes 216, 460, 470, 473, and 743, hospitals may also use an APR-DRG code.

The consumer-friendly display does not have to be an interactive tool for consumers. If a hospital has an online price estimation tool on their site that includes 300 or more shoppable items and services and also provides an out-of-pocket estimate for patients, such a tool could be an acceptable alternative according to CMS.

However, implementing the consumer-friendly display may be a lower cost or more expeditious solution than the interactive price estimation tool option. Alternatively, the consumer-friendly display may be considered as a precursor phase to implementing the interactive price estimation tool. Under either method, providers are required to produce the machine-readable file and to analyze data to determine the 300 (or more) shoppable items and services for the consumer display or tool.

These transparency initiatives may burden many hospitals with high costs, high charges, and higher than average negotiated rates—often for good reasons such as inadequately reimbursed teaching costs, high federal payer utilization where less than cost is reimbursed, and/or atypically high uncompensated care costs, etc. This puts these providers at a competitive disadvantage.

Accordingly, identifying those areas where charges, rates, or quality of care can be favorably presented against other market areas or comparable providers may be useful enhancements to your online consumer display.

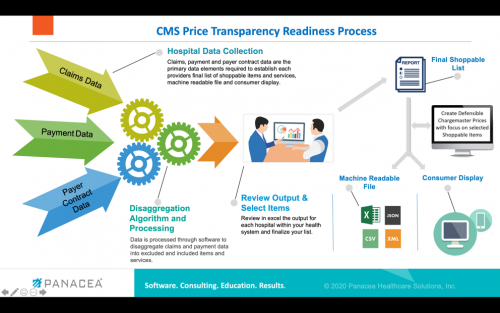

4-Step Workplan To Ensure Preparation

With only ten months to go before the required implementation date, providers should take heed and begin to prepare now. The following 4 step workplan should be considered.

1. Develop Your List of 300 or More “Shoppable” Items and Services.

The CMS final rule requires that each provider within a health system determine its own unique list of non-urgent “shoppable” items and services. This list needs to consider volume and/or revenue in the process.

It would be prudent to take a step back from the detailed requirements and guidance provided by CMS (and lack thereof). The initial focus should be on identifying your hospital’s “shoppable” services and service packages as well as gathering the data required for the consumer-friendly display.

It’s important to remember that providers can go beyond the minimum required by CMS. If additional information will be helpful to consumers or your team when they are trying to determine which items and services will be easiest to display to the consumer, consider collecting and providing more information than required.

For example, in your analysis and selection process, isolate first the items and services that are most often directly related to a simple and single fee schedule rate, DRG rate, or other case rates without multiple contract provisions and calculations required such as carve-outs, additional per diems for excess days, etc. Gathering additional information for the consumer, even though NOT required by CMS, such as showing the average range of inlier charges and payments and disclosing related items and service categories that they may fall into would also be useful. For example, you could show with CC, with CC and MCC, and without CC or MCC rates or show average LOS for per diem-based items and services.

To perform optimum analytics in this step leveraging the power of technology with hierarchical disaggregation logic to process 12 months of claims and payment data is highly recommended.

2. Establish Rational and Defensible Chargemaster Prices with Consideration of “Shoppable” Items.

The final rule requires that hospitals display the gross charge(s) for the “shoppable” items and services. It is important to note that, as with the list of 70 shoppable items required by CMS, many items will be single chargemaster level items utilized by private outpatients.

Accordingly, hospitals should continue to update their chargemasters in a rational and defensible manner with gross and net revenue modeling considered—but with new consideration given to the selected and complete list of shoppable items. Many hospitals will have 50% or more of their 300 items listed in their CDM with sometimes 200% or more items being related (e.g., with contrast, without contrast, and with and without contrast). This makes rational pricing scrutiny and modeling on more than those items required to be listed by CMS critical.

Providers can consider tagging those CDM items included in each of their hospital’s final unique shoppable list to allow for “what-if” modeling and to determine the extent that such prices can be further decreased with little or no impact on net revenue.

Providers may want to also consider implementing split pricing where prices for outpatients are established at levels below inpatients for like “shoppable” items and services but where gross and net revenue modeling is prepared prior to implementation.

3. Create a Consumer-Friendly Display.

With your “shoppable” list developed and chargemaster prices aligned, you are now ready to pull together the charges and/or negotiated rates from your payer contracts in accordance with the rule outline above.

It is likely you will have difficulty aligning all of your shoppable items and services in strict compliance with CMS requirements, especially for items and services with varied and multiple payment methodology provisions. For example, for a hip replacement one payer may be paying a per diem, another a percentage of charges, and a third a case rate but with a carve-out for the implant and stop-loss provision. There will be no way to display a comparable negotiated rate/charge for the consumer display nor in the machine-readable file.

Based on a recent call with the CMS Price Transparency team we expect further guidance from them in the future. However, in the meantime and based on CMS feedback providing information such as the average inlier payment resulting from those disparate payer terms as this option is more meaningful to a consumer anyway.

4. Publish a Machine-Readable File.

Providers will require more guidance from CMS on this item for the same reasons described under the consumer display. Nonetheless, as a starting point, providers can summarize their contract terms for each payer. Where commonality exists, they can begin to lay out the information in accordance with the requirements.

There will be many instances—such as for private outpatient items and services having HCPCS codes—where the code, description, and negotiated single item’s fee schedule amount for each payer can be displayed, as required, and where the gross charge from the CDM can be displayed (if paid charges for certain payers). From this information the lowest/minimum and highest/maximum negotiated charge or rate can be included along with the setting. Absent further guidance from CMS, for those items that simply do not align, the best you may be able to do is to include a tab(s) summarizing the negotiated terms or rates, in the most user-friendly and comparable way possible.

It is important to mention that in the event the final rule is overturned or modified, much of the data being pulled together can be very useful to consumers regardless of the CMS requirements. For example, providing consumers the average charges and payments or range of charges and payments across all payers and for the top 300 or more “shoppable” items is certainly more helpful than providing only the chargemaster. Splitting this out further between in-network and out-of-network categories would be another welcome addition for building a consumer-friendly display. Finally, stay tuned to any further guidance likely to be provided by CMS in coming months to determine if your own workplan needs to be modified.

Written by: Frederick Stodolak, CEO Panacea Healthcare Solutions

This article originally appeared on RACMonitor.com on March 4, 2020.